Wed, 11 Feb 2026

|DHIVEHI

MIRA to modernise tax administration

02 Aug 2025

|

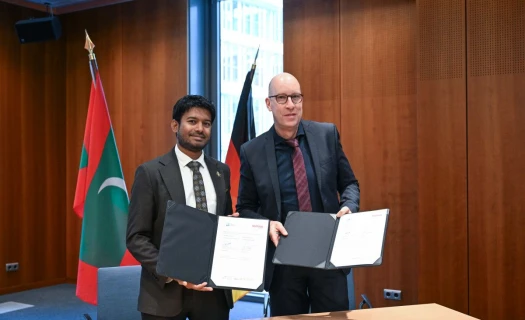

MIRA's Commissioner General of Taxation, Hassan Zareer-- Photo: MIRA

The Maldives Inland Revenue Authority (MIRA) has announced a major digital overhaul of its tax administration, as part of a long-term roadmap to enhance compliance and operational efficiency.

The initiative was unveiled by Commissioner General of Taxation Hassan Zareer during MIRA’s 15th anniversary celebration. The transformation centres on the introduction of an electronic invoicing system, based on international models, which will directly connect taxpayer platforms with MIRA’s systems. The new system is expected to simplify procedures, improve transparency, and reduce administrative complexities for taxpayers.

MIRA has already made significant strides in digital adoption. According to Zareer, 97 per cent of tax statements and 99 per cent of payments are now processed online. He noted that these achievements reflect the agency’s continued focus on digital service delivery and public sector innovation.

Since its establishment in 2010, MIRA has seen substantial growth in revenue collection. In 2011, the agency collected USD 295.7 million, a figure that rose to USD 1.82 billion by 2024. MIRA now contributes 82.5 per cent of the Maldives’ total national revenue.

Launched with a team of 40 staff, the authority has expanded its operations across 18 offices nationwide, employing over 300 personnel. As MIRA enters its 16th year, efforts are underway to strengthen administrative capacity and enhance technical capabilities in response to evolving demands.